The 29th United Nations Climate Change Conference (COP29) in Baku marked a pivotal advancement in global climate policy, particularly concerning the operationalization of international carbon markets under Article 6 of the Paris Agreement and the establishment of a new climate finance target. These developments carry significant implications for the business sector, presenting both opportunities and challenges.

Operationalization of Article 6: Implications for Carbon Markets

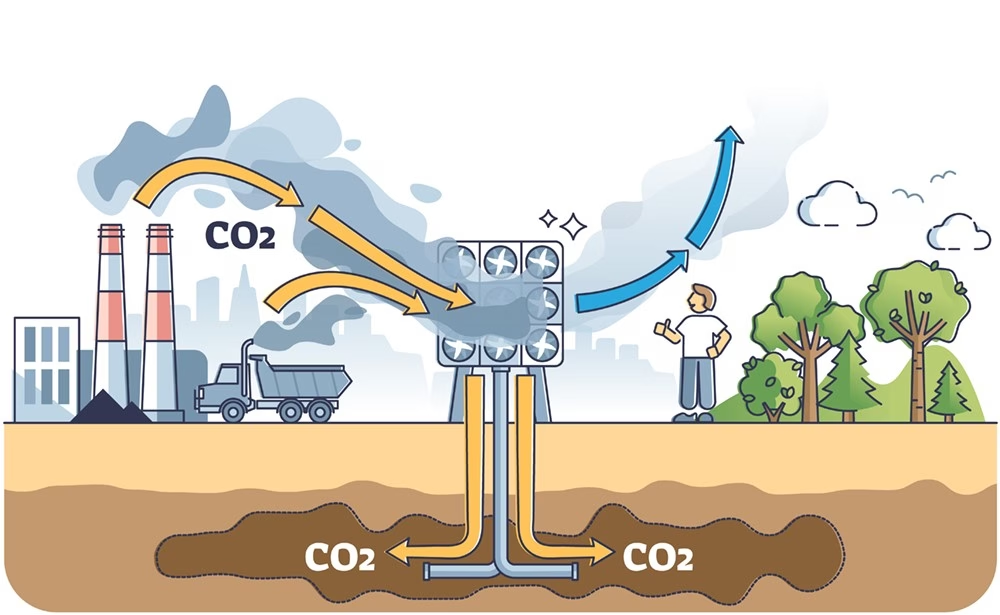

After years of protracted negotiations, COP29 achieved consensus on the guidelines for Article 6, facilitating the creation and exchange of carbon credits between nations. This framework is designed to enhance transparency and environmental integrity in carbon trading, thereby fostering a more robust global carbon market.

For businesses, this development offers a dual-faceted impact:

- Investment Opportunities: The establishment of a regulated carbon market opens avenues for investment in emission reduction projects, particularly in developing countries. Companies can engage in carbon offset initiatives, potentially yielding financial returns while contributing to sustainability goals.

- Regulatory Compliance and Market Access: Enterprises operating in jurisdictions with stringent emission regulations can utilize carbon credits to meet compliance requirements. Moreover, participation in international carbon markets may become a prerequisite for accessing certain markets, necessitating strategic alignment with these mechanisms.

However, businesses must navigate complexities related to the quality and authenticity of carbon credits. Concerns have been raised regarding the potential for carbon markets to allow major polluters to offset rather than reduce emissions, underscoring the necessity for rigorous due diligence and adherence to high standards.

Climate Finance Target: Mobilizing Resources for Sustainable Development

COP29 concluded with developed countries committing to mobilize at least $300 billion annually by 2035 to assist developing nations in addressing climate change. This figure, while an increase from the previous $100 billion target, falls short of the $1.3 trillion demanded by developing countries.

For the private sector, this commitment signals a substantial mobilization of resources towards sustainable projects, presenting several considerations:

- Investment Potential: The influx of climate finance is expected to catalyze projects in renewable energy, sustainable agriculture, and resilient infrastructure. Businesses can explore partnerships and investments in these areas, aligning with global sustainability trends.

- Corporate Responsibility and Reporting: Companies may face increased expectations to contribute to climate finance, either through direct investments or by aligning operations with sustainability objectives. Transparent reporting and adherence to environmental, social, and governance (ESG) criteria will be crucial.

Despite the pledged amounts, the effectiveness of these funds hinges on their allocation and utilization. Developing nations have criticized the $300 billion commitment as insufficient, highlighting the need for innovative financing mechanisms and greater private sector involvement to bridge the gap.

Strategic Considerations for Businesses

In light of COP29 outcomes, businesses should adopt a proactive approach to integrate climate considerations into their strategic planning:

- Risk Management: Assess exposure to regulatory changes and market dynamics influenced by evolving climate policies. Develop strategies to mitigate risks associated with carbon pricing and compliance obligations.

- Sustainable Innovation: Invest in research and development of low-carbon technologies and sustainable practices. Innovation in this realm can lead to competitive advantages and access to emerging markets.

- Stakeholder Engagement: Engage with policymakers, industry groups, and civil society to stay informed about climate policy developments. Active participation can influence favorable outcomes and ensure alignment with global standards.

The decisions made at COP29 underscore the imperative for businesses to integrate climate action into their core operations. By aligning with international frameworks and contributing to global sustainability efforts, companies can not only mitigate risks but also capitalize on new opportunities in the transition to a low-carbon economy.