In a significant move to advance carbon capture and storage (CCS) initiatives across the Asia-Pacific region, the Asia Natural Gas and Energy Association (ANGEA), in collaboration with the Boston Consulting Group, has unveiled a comprehensive framework aimed at expediting CCS projects and facilitating related cross-border trade. This development is poised to play a pivotal role in the region’s pursuit of net-zero emissions.

The newly introduced framework draws upon insights from European and North American experiences, as well as established international standards and protocols. Paul Everingham, CEO of ANGEA, emphasized its utility for governments in negotiating cross-border CCS arrangements, stating, “We envision our framework as a resource for governments to reference when negotiating cross-border CCS arrangements.”

The Asia-Pacific region has witnessed a notable increase in CCS projects, with over 50 initiatives spanning from Japan to India, up from approximately 30 the previous year, according to the Global CCS Institute. However, the majority remain in preliminary stages, with few having commenced full-scale operations.

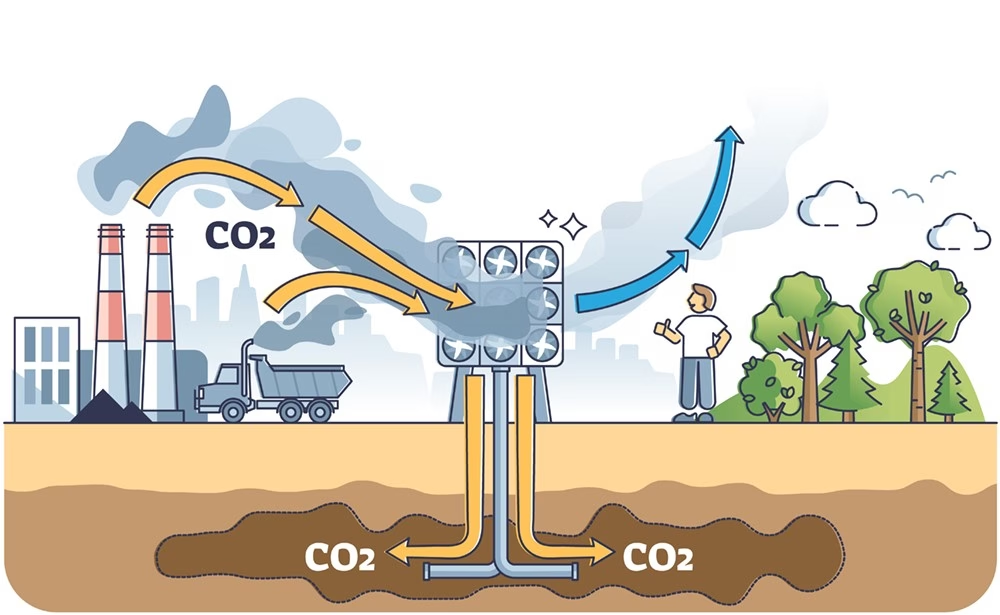

High-emission nations such as Japan, South Korea, and Singapore possess the capability to capture CO₂ but face limitations in geological storage capacity. This constraint has prompted these countries to seek partnerships that enable the transportation and storage of emissions in neighboring regions. Conversely, countries like Indonesia, Australia, and Malaysia, endowed with ample storage reservoirs such as depleted oil and gas fields, are eager to capitalize on these opportunities.

The ANGEA framework addresses critical challenges in forming bilateral or commercial CCS agreements, including the allocation of emission reduction claims and the generation of carbon credits. It also underscores the necessity for clear jurisdictional accountability in the event of emission leakage during storage and mandates rigorous carbon measurement, reporting, and verification processes, including the engagement of certified third-party auditors.

While existing agreements like the Paris Agreement and the London Protocol provide foundational support for cross-border CCS projects, they often lack detailed guidance on practical implementation. Everingham highlighted the urgency for operational cross-border CCS projects by 2030 to meet emission reduction targets, urging governments to expedite bilateral agreements to facilitate private sector participation.

ANGEA’s membership includes major energy corporations such as BP, Chevron, ExxonMobil, Australia’s Santos, and Japan’s Mitsubishi Heavy Industries. Taichi Tanaka, Engineering Manager of the GX Business Department at Mitsubishi Heavy Industries, expressed optimism that the framework would accelerate project implementation, noting the complexity of CCS mechanisms and the essential nature of international collaboration across the value chain.

Indonesia has emerged as a proactive player in CCS hub development, hosting at least 15 projects in various stages of progress, more than doubling the number from the previous year. These initiatives often involve international partnerships. Notably, BP and its partners have committed $7 billion to a CCS and gas field development project in Indonesia’s West Papua province, with production at the Ubadari field slated to commence in 2028. The captured CO₂ will be utilized to enhance production at BP’s Tangguh LNG facility, marking BP’s inaugural carbon capture, utilization, and storage project.

Additionally, ExxonMobil has pledged a $15 billion investment to advance CCS technology in Indonesia, further underscoring the region’s growing commitment to carbon mitigation efforts.

These developments signify a concerted effort among Asia-Pacific nations and energy conglomerates to harness CCS technology as a cornerstone in achieving ambitious net-zero objectives, fostering a collaborative approach to regional decarbonization.