Vietnam’s emerging carbon market presents a promising avenue for investors and businesses seeking to finance sustainable agriculture projects and generate carbon credits. With nearly 40% of its land area—equivalent to 13 million hectares—dedicated to agriculture, Vietnam holds a strategic advantage in the global transition to low-carbon food systems.

Agriculture contributes around 16–17% of national export earnings, with key commodities such as rice, coffee, rubber, and cashew forming the backbone of rural livelihoods. Although its share of GDP is declining, the sector maintains steady growth at 2–3% annually. Notably, agricultural exports reached a record US$53 billion in 2022. These structural strengths are matched by vast reserves of agricultural residues—rice straw, husks, bagasse, corn stalks, and livestock manure—that can serve as feedstock for verified carbon credit (VCC) projects.

Carbon Credit Opportunities from Agricultural Resources

Vietnam’s agricultural sector offers diverse pathways for carbon credit generation through both waste management and sustainable farming practices:

• Agricultural residues: Vietnam produces an estimated 118 million tonnes of crop residues annually, 80% of which originates from rice cultivation. Rather than burning residues—a major source of air pollution—these by-products can be composted, transformed into biochar, or converted into biomass energy. For instance, Verra’s VM0044 methodology standardizes the process of converting organic waste into biochar, which stores carbon in soil while enhancing fertility.

• Manure and biogas systems: With over 5 million cattle, 30 million pigs, and 300 million poultry, Vietnam generates vast quantities of manure. Left untreated, this is a potent source of methane. Biogas digesters offer a dual solution—capturing methane for energy while reducing GHG emissions. Several industrial pig farms in the Mekong Delta already combine livestock rearing with biogas electricity generation, creating potential carbon revenues.

• Organic and regenerative practices: Techniques such as zero tillage, cover cropping, and organic amendments improve soil health while sequestering CO₂. Regenerative agriculture also reduces erosion and improves water retention—making it well-aligned with carbon certification frameworks. For rice, improved field management techniques such as alternate wetting and drying (AWD) significantly cut methane emissions and are now recognized under Verra’s VM0051 methodology.

Global Best Practices in Carbon Farming

Emerging economies have already demonstrated the viability of carbon farming as a dual tool for climate mitigation and rural development:

• India: In January 2024, the Ministry of Agriculture launched a national framework for voluntary carbon markets in farming, encouraging sustainable cultivation methods and certifiable mitigation activities. Pilot programs supported by the Indian Council of Agricultural Research employ Verra methodologies such as VM0042 (Improved Agricultural Land Management) and VM0044 (Biochar) to train farmers and aggregate carbon credits.

• Kenya: Backed by the World Bank, the Kenya Agricultural Carbon Project (KACP) was among the first to issue VCS credits for smallholder farmers in 2014. Covering over 45,000 hectares and 60,000 farmers, the project used sustainable land management (SLM) techniques to build soil organic carbon and enhance yields by 15–20%, while generating carbon revenues.

• Latin America: Brazil’s focus on REDD+ is now complemented by agroforestry and low-emission farming projects using biochar and integrated cropping systems. Throughout the region, climate-smart practices like drip irrigation, cover cropping, and agroforestry are gaining traction. These examples demonstrate scalable models Vietnam could adapt through South-South collaboration and technology transfer.

Approved Methodologies for Agricultural Carbon Credits

Key carbon standards such as Verra’s VCS and Gold Standard have established several methodologies applicable to agriculture:

• Improved Agricultural Land Management (VM0042): Covers practices like reduced tillage, composting, liming, and crop rotation that reduce emissions and enhance carbon sequestration.

• Rice cultivation emissions reduction (VM0051): Targets methane reduction through water management and improved crop varieties. Similar methodologies under Gold Standard provide robust tools for CH₄ reductions in the Red River and Mekong deltas.

• Biochar (VM0044): Certifies emissions reductions through biochar production from crop residues. Biochar sequesters carbon for hundreds of years when incorporated into soil.

• Livestock methane mitigation: While not yet standardized under Verra, projects applying improved feed, organic husbandry, or manure management via biogas digesters can be evaluated under related MRV frameworks.

• Agroforestry and reforestation (VM0047): Projects involving tree intercropping or shifting from annual to perennial crops are eligible under afforestation methodologies.

With rigorous MRV and additionality protocols, nearly all sustainable agricultural practices in Vietnam could become eligible for carbon credit generation.

Market Demand for Agricultural Credits

Both compliance and voluntary markets are driving increased demand for high-integrity carbon offsets:

• Voluntary market: Over 60% of Fortune 500 companies have net-zero commitments by 2050. Many prefer offsets with co-benefits such as biodiversity conservation and community resilience. Agricultural carbon credits, when verified transparently, are well-positioned to meet this demand—particularly as nature-based solutions face scrutiny around permanence.

• Compliance market: Although the EU ETS does not yet cover agriculture directly, carbon border adjustment mechanisms (CBAM) will soon require agricultural exports to disclose emissions footprints. Domestically, Vietnam’s Decision 232 (January 2025) allows ETS-covered firms to offset emissions using Certified Carbon Credits (CCC), potentially creating local demand for agriculture-linked carbon credits.

Vietnam’s Domestic Carbon Market: A Catalyst for Green Investment

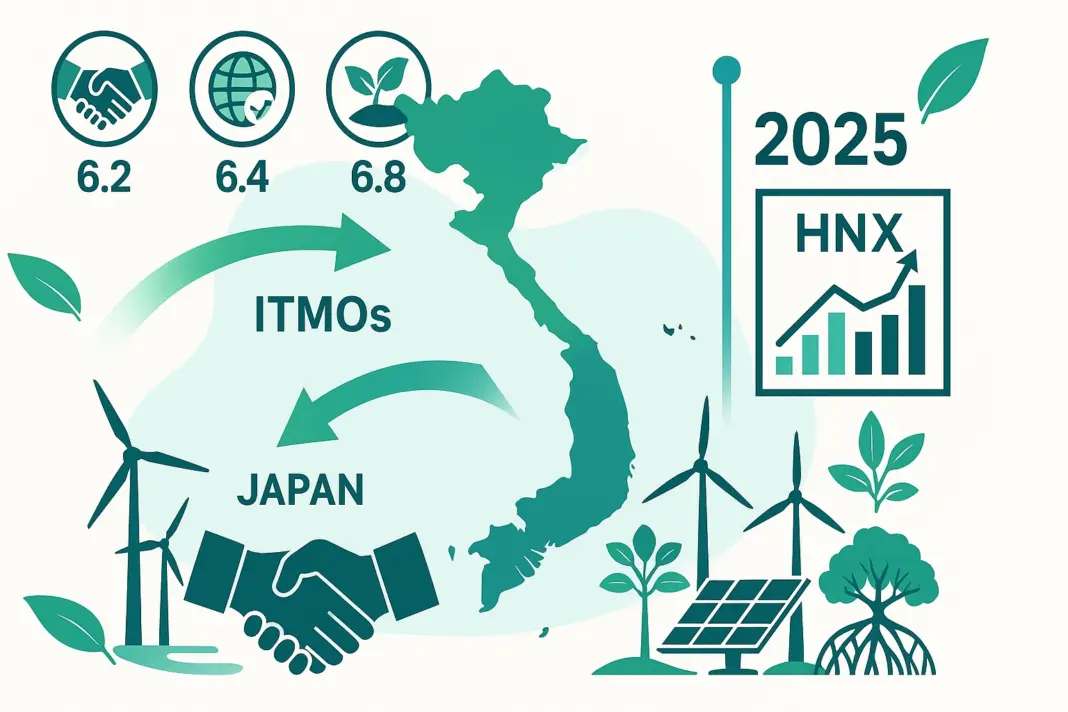

Vietnam is building the institutional infrastructure for a national carbon market. Decision 232 outlines a roadmap for an Emissions Trading Scheme (ETS), with a pilot phase beginning June 2025. It includes mechanisms to accept credits from domestic and international sources (CDM, JCM, Article 6).

The amended Law on Environmental Protection (2020) recognizes “carbon products” and encourages emissions reductions in agriculture. A sandbox for climate finance is also in the works to attract green investment into pilot projects. Once operational, the domestic market could channel new revenue streams into rural areas—supporting biogas infrastructure, residue-processing plants, and smart organic farming systems.

Policy and Investment Recommendations for 2025–2035

To unlock Vietnam’s agricultural carbon credit potential, stakeholders should consider the following strategies:

• Regulatory clarity: Finalize guidelines for carbon credit issuance in agriculture and integrate methodologies into regional development plans. Incentivize sustainable zones through tax reliefs and biogas subsidies.

• Capacity building: Scale up extension services and farmer training on MRV protocols and sustainable techniques. Encourage farmer cooperatives to participate in credit aggregation schemes.

• Green finance access: Create risk-sharing mechanisms for agri-carbon investment. Promote green loans and agricultural climate bonds to crowd in both local and international capital.

• International cooperation: Partner with global climate finance institutions and regional networks (e.g., ASEAN, APN) to share knowledge, pilot models, and build investor confidence.

With rising global demand for high-quality offsets and a growing appetite for climate-smart investment, Vietnam’s agricultural sector offers a competitive edge. By linking carbon farming with rural development, the country can mobilize climate finance at scale—turning rice paddies, crop residues, and regenerative practices into investable carbon assets.

Vietnam’s carbon market, if well-governed, can serve as a blueprint for inclusive green growth in the Global South.